UWINC Commercial Invoice free printable template

Show details

Left mouse click numbers to see instructionsCOMMERCIAL INVOICE

?SHIPPER / EXPORTER (Full name and address) 1COMMERCIAL INVOICE NO.

CUSTOMER P.O.NO.

COUNTRY OF ORIGIN?CONSIGNEE (Full name and address)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign w9 invoice form

Edit your w9 invoice template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w9 and invoice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pdffiller w9 online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit w9 form sample. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out invoice w9 form

How to fill out UWINC Commercial Invoice

01

Start with the header section: Fill in the invoice date, invoice number, and your company’s name and contact details.

02

Include the buyer's details: Write the name, address, and contact information of the recipient.

03

Describe the goods: List the items being shipped, including their quantity, description, and unit value.

04

State the total value: Calculate the total value of the goods and write it in the designated field.

05

Include shipping information: Specify the shipping method, terms, and any relevant tracking details.

06

Sign and date the invoice: Make sure to provide your signature and the date of completion.

Who needs UWINC Commercial Invoice?

01

The UWINC Commercial Invoice is needed by exporters, importers, customs officials, and shipping companies involved in international shipments.

Fill

w 9 invoice

: Try Risk Free

People Also Ask about sample w9

How do I edit an invoice in PDF?

Here's how to do it for text-based PDF invoices: Open Microsoft Word on your PC. Click on Open, search for the PDF invoice, and open it in Word. You'll get a prompt that Word will now convert your PDF into an editable document. Your invoice will open in Word, and you will see that you can edit the text easily.

How do I fill out an invoice online?

What to include on an invoice. The name and contact information of the vendor and customer. An invoice number for payment tracking. The date of the transaction and date of invoice. The payment due date. A list of sold products or services with prices. Any pre-payments or discounts.

How do you fill out an invoice and send it?

What To Include In An Invoice Invoice number. Business name and contact information. Recipient's name and contact information. Description of services rendered (itemized list of services optional) Total price (including any additional fees, if applicable)

How do I fill out an invoice in PDF?

To fill out an invoice, you'll just need to include the following: The client's name, company name, address, phone number, and email. Your name, business name, address, phone number, and email. Invoice number. Date. Description of product or services, unit amount, unit cost, total (i.e., line items) Tax. Grand total.

How do you fill out an invoice step-by-step?

Learn how to write an invoice: Start with a professional layout. Include company and customer information. Add a unique invoice number, an issue date, and a due date. Write each line item with a description of services. Add up line items for total money owed. Include your payment terms and options. Add a personal note.

How do I fill out an invoice request form?

How to Fill Out an Invoice: Step-by-Step Step #1. List Business Contact Information. Step #2. Write the Client's Contact Details. Step #3. Generate a Unique Invoice Number. Step #4. Clearly Display the Dates. Step #5. Step #6: Display Pricing. Step #7. Step #8: Write Down Payment Terms and Any Additional Notes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sending a w9 with invoice in Gmail?

w9 template and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I create an electronic signature for signing my uwinc in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your awb template and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit UWINC Commercial Invoice straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing UWINC Commercial Invoice, you need to install and log in to the app.

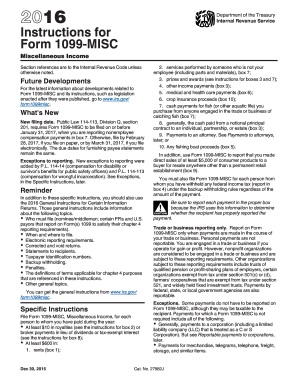

What is UWINC Commercial Invoice?

The UWINC Commercial Invoice is a document required for the declaration and valuation of goods being imported or exported, providing detailed information about the transaction.

Who is required to file UWINC Commercial Invoice?

The UWINC Commercial Invoice must be filed by importers, exporters, and customs brokers involved in the trading of goods across borders.

How to fill out UWINC Commercial Invoice?

To fill out the UWINC Commercial Invoice, provide accurate details such as the seller's and buyer's information, item descriptions, quantities, prices, and any applicable shipping and payment terms.

What is the purpose of UWINC Commercial Invoice?

The purpose of the UWINC Commercial Invoice is to facilitate customs clearance, ensure compliance with trade regulations, and provide necessary financial records for both buyers and sellers.

What information must be reported on UWINC Commercial Invoice?

The UWINC Commercial Invoice must report information including the seller and buyer's names and addresses, invoice number, date, item descriptions, quantities, unit prices, total value, and terms of sale.

Fill out your UWINC Commercial Invoice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UWINC Commercial Invoice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.